Комментарии:

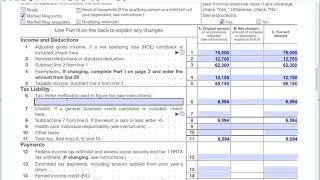

How come TurboTax is trying to only give me $500 per kid?

I make a little more than 100k with 2 kids that qualify.

Wait, you totally skip over Line 13 of Schedule 8812: Credit Limit Worksheet A. You have a number entered there, and the $4,000 only carries to Line 14 if it is smaller than the amount in Line 13 (from Credit Limit Worksheet A). I can't find Credit Limit Worksheet A anywhere.

Ответить

Followed it all the way to the Schedule 8812 and the amount that just showed up on Line 13 of that form. Where did that come from?? You did not show a Credit Limit Worksheet A part and how to fill that out to get the Line 13 on that 8812 form.

Ответить

Which Tax Filing program/app are you using? I'm using the form provided in the IRS website. I like how yours 'Autofills' and does the math.

Ответить

numbers on line 13 ??? I am confusing

Ответить

Well explained. Thank you👍🙏

Ответить

From what I understand, you can only get back as much as you pay in to the fed, nothing more, unlike last year

Ответить

Thank you! Super clear and informative. Was struggling with line 13 on schedule 8812 and you cleared my issues right up!

Ответить

Great explaination of concept one of the best, but flipping back And forth got to me. Dizzy after watching the video. Wow

Ответить

Great Video! I was wondering when should people file married filed separately. Let's say one spouse cashed out an IRA early and didn't have tax withheld but that was the spouse's only income, let's say 35K. Wouldn't it make sense to file separately and have the spouse who withdrew the 35k claim the child tax credit?

Ответить

Paid over $18k for ChildCare and only getting $600 back smh

Ответить

Can you do one for people on SSDI and 1 dependant

Ответить

I'm on SSI so I won't be able to claim my son ?

Ответить

Great video!! I love seeing exactly how to understand the tax forms!!!

Ответить

Do you have a 1040SR for seniors to tax form to show line by line!

Ответить

![[PoE] Stream Highlights #308 - First! [PoE] Stream Highlights #308 - First!](https://ruvideo.cc/img/upload/Z0NiVWlsY2dPcGQ.jpg)