Комментарии:

So I got audited and never got why I was to get 14568 and got 5000 how do I amend that as a small business owner

Ответить

I’m what box should we put education expensss that were not seclared

Ответить

Can I do this for ERC program

Ответить

My 1099G wasnt filed in 2020 and 2021. Can I file it using this form?

Ответить

can you amend a 2021 return and add to your ira to reduce your tax burden?

Ответить

Thank you. This is helpful. I need help on the 1040x, My friend took out 35,000 during covid time. She didn't have to pay back for 3 years. Now the IRS asked her to file a deficiency and along with 1040x for her 2020 tax year. How would she go about doing this?

Ответить

2023 E filed taxe return still shows not processed, for over 3 weeks in till I got referred to her and she assisted me last week I got my taxe return in my account

Ответить

If I did not entered one 1099 detail information but I did include the income as other income when I filed the return, how can I do the amended return while I don’t have any increased tax liability

Ответить

How did you send in your electric tax return

Ответить

Is this the form I should use if the IRS claimed my child didn't exist even though he definitely does? We need to repeal the 16th Amendment, this is a nonsensical mess...

Ответить

Very helpful video, thank you! What forms must I include with this? Do I include my original 1040 form with it?

Ответить

The state sent me the adjustment amount for unemployment for 2021. How do I document that on the 1040-x?

Ответить

Thanks for the video. What if I forget to report a 1099-D (for dividends) because I received the form later after I’ve already filed my taxes. Where do I enter the dividend income? It’s around $160 total

Ответить

if im single just claiming 1 for myself, do I leave line 4 blank??

Ответить

Do you have form 1045 as an example of how to fill out.

Ответить

Could I pay for you to fill one out for me

Ответить

Thanks so much for this video! I have a question I need to make an amendment after receiving the refund payment, I received my 1099 R in the mail. taxes were taken out the distribution before it was dispersed but how would I document the amount I got for the tax refund payment on the 1099x form ?

Ответить

Free?

Ответить

John, If I have business (organizational/startup) expenses from my single-member LLC, I was told I can add them to my personal taxes (Schedule C). I want to amend my original 1040, using 1040X/Schedule C, to include these expenses. Doable you think? Thank you SO very much for the videos & resources, you are truly AWESOME!!

Ответить

I used the non-filers option in October 2020 for 2020 taxes to get the stimulus check. Since I didn’t download anything for my own records I requested a transcript and received a reply in the mail “no record of tax return filed” and am wondering if I should file a 1040 including interest income 1099 which I forgot to include.

Ответить

This legit saved my ass! Thank you, sir!

Ответить

Great job, John! I do have a question. I received a corrected 1099 where they moved some money from line 1b - Qualified Dividends to line 3 - Nondividend Distributions. Does this require a 1040X, and if so, any advice on how to do it correctly? I'm a bit lost. Thanks in advance! Cary

Ответить

TY TY TY REALLY HELPED OUT

Ответить

Hello. My employer reported $2,000 as social security tax withheld while $3,000 was withheld.

On which line should I report the correct amount of the social security tax withheld on 1040-X?

I downloaded and purchased the 1040x . not sure if the code is working. plz help

Ответить

hey if i didnt file for 2018,2019,2020,2021,2022 i would like to amend those because i never recivbed any stimulus checks and never got my pua

Ответить

Hello, I filed ira 2k in original tax, but was denied at bank because pass the dead line of 4-18-22?

Please advise. Thank you 🙏

Ps. Do you have to send in all the original ( 1040, schedule a,b etc...) again with this amended one ?

I really need help with filing my 1040x I need to add my unemployment from 2021 and add my other child that was not claimed.

Ответить

No mention on what documents should be mailed in addition to the 1040X if any.

Ответить

I am filing a 2019 amended tax return. The only thing I need to change is the dependents section and claim the child tax credit. I don't know how to complete form. Help

Ответить

I have a rental property and had many repairs done. When I filed I used an online service that didn't allow depreciation using the form 4562. Can I use the 1040x to amend that return and would I also send in a form 4562 for depreciating the cap ex improvements of around 20k?

Ответить

So is this the only form I'd have to send to them along with the signed portion only

Ответить

Hi there, I clicked the link that takes to the self-calculating IRS forms, but this form 1040-X is not available :(

Ответить

Hi , I have to amend my tax for the year of 2018 , first is that still okay to do , and secondly the amendment is because I failed to claim the CHILD TAX CREDIT that year and I qualified for it . I do not see anything on the 1040-x where I can add that information. Can you please guide me in the right direction? Thank you so much for your anticipated help in this matter

Ответить

how do you add a 300 charitable contribution to the standard deduction is it a separate line or can you just add it to the standard deduction

Ответить

FINALLY someone who speaks English. Thanks so much for this video boy imma tell ya I was bout to mess up big time in this form til I watch this video damn dodged bullet on that one phew

Ответить

Hi thank you for the video, but you might want to cover up your clients socials yes the video was helpful by the way

Ответить

it was clear but I'm still lost! last time I do my taxes by myself. I'm about to be audited. . .

Ответить

THANK YOU!!!!!!!!!!!!

Ответить

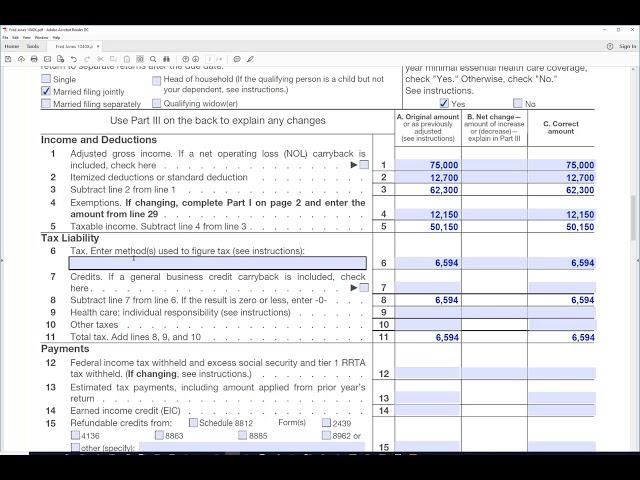

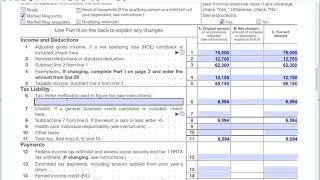

You put in the single standard deduction on the video. You are showing Married Filing Jointly. Helpful video though.

Ответить

would tax witheld be the combined taxes? im a bit confused as i am trying to fix something

Ответить

I have a very, very time sensitive question. For line 5 of the 1040 X Rev July 2021. For line 5 it says subtract line 4b from line 3. If result is zero or less, enter 0. Which column do I put the zero sum? My relative had no taxable income so would I put the zero in column A B or C?

Ответить

So I filed about a month ago and already got my return but then robinhood sent me my 1099 since I'm new I didn't know I was getting one since I only made $211.17. So what do I do?

Ответить

Hi very good video but still a little confused. But my question on this form it includes the previous w2 s and the one you might have forgotten as well?

Ответить

I forgot to add a 1099 G unemployment

Would I put that amount in the same box you put their missing W2?

Thank you so much! I was getting frustrated, figuring out how to do taxes on my own, but you made the process much easier for me.

Ответить

What if i forget to put in my missing $1,400 3rd stimulus check?

Ответить

the link doesn't have a 1040x, Amend Tax Return self calculating, which is what I need. But, thank you for the video.

Ответить

What if you want to change just your dependants?

Ответить

HOW DO YOU ADD BANK ACC INFO ON THE 1040X?

Ответить

![[PoE] Stream Highlights #308 - First! [PoE] Stream Highlights #308 - First!](https://ruvideo.cc/img/upload/Z0NiVWlsY2dPcGQ.jpg)