Комментарии:

very nice!

Ответить

thanks!

Ответить

Thanks. Nice and straightforward.

Ответить

this is awesome.

Ответить

Great explanation! Essentially, you are using continuous compounding to find the period over period rate of return for your hypothetical portfolio. Maybe I need a better understanding of modern portfolio theory, but if return is based on dividends and or capital gains realized(from an accrual accounting perspective) at the end of each period, then the simple or discrete method would seem to be the more practical choice. Under what scenario would we want to use logs to calculate return?

Ответить

@chatturanga so what is the correct way to use weighted returns over time ie. cumulative returns for a portfolio with unequal weights if both methods mentioned in the video don't work? Is this possible?

Ответить

Hey David, thanks for a nice video Say the price of an asset is 13,13 at day one and 1,81 at day to, thus the logreturn between day one and to is -198,16%, how schould this be understud??

Ответить

i would love to see an example of how these log returns take the assets in period 1 to period 3. for instance, how would you use these log returns to take asset A (p1) = 100 to asset a (p3) ??

Ответить

hi what is cumulative return if i have return in month 1: 3% month 2: 4% month 3: 7% pls help

Ответить

really well explained

Ответить

People like you putting up material like this is probably the best part of the internet. Thank you very much. Very well explained.

Ответить

Since using log returns have disadvantages over discrete returns can you please explain an instance when to use log returns and when not while analyzing or calculating returns?

Ответить

Taking first difference of asset price process [I(1)=>first difference stationary] sufficiently removes mean non-stationarity After the first differencing is performed, there is still variance non-stationarity.Thus, one could use a scaled Box-Cox transformation. One would usually get a lambda=0 within the confidence bounds, thus use the GM(y)*log() or simply log() transformation.Thus the asset price process should be transformed into=> first difference of the log process {r(t)=ln(P(t)/P(t-1) }

Ответить

The first difference of log-asset price process still contains non-level variance non-stationary. Given unconditional distribution extreme non-normality, conditional heteroscedasticity, asymmetry in volatility response and conditional distribution non-normality, one should additional modify the model to incorporate volatility clustering, asymmetrical responses and non-volatility clustering induces excess kurtosis==> DMM-MFIEGARCH with tempered stable innovations

Ответить

This is an excellent video, but I have another disadvantage.

I've found that using log returns on anything non-equity related such as futures just further clouds the practicality of the analysis, assuming you're actively trading using this information. With frequent trading, you do not care what the returns of a product are because you are trading on price/value. It is much more practical to standardize the price changes another way, for example a pearson correlation, to actively trade than to consider compounding returns for any sort of strategy. For a holding portfolio of equities, yes this makes perfect sense, but it's all about the application of the math.

Excellent!!! Thanks!!!!!

Ответить

Thanks David. It sounds like the upside is only in case of Gaussian-ness, whereas the downside is pretty big (not additive across portfolio weightings). A sensitivity analysis on the portfolio weights seems like the most obvious question to be asking all the time ("Should I switch some of A into B?"), so why does the balance fall on the side of using logs?

Ответить

Many thanks

Ответить

Isn't e value is approximate? So, it can't be used as equality.

Ответить

100*(1+r) = 120 .... r is not 18.2% by using ln are compounding daily?

Ответить

Very clear-cut, thank you.

Ответить

Yes but what does time additive actually mean? How much time?

Ответить

It works ?

Ответить

thanks for the video. one question: so do you need recalculate the weights for P2 return?

Ответить

G

Ответить

great!

Ответить

I'll have to look into this, is it the best channel?

Ответить

well what an eye opener :D

Ответить

I have seen people using Natural Log "log (p2/p1)", while calculating daily returns of stock/Index for long period data (15-20 years), instead of using '(p2 - p1)/p1'. Could not know very good reason.

Is it more accurate to use Natural Log ?

Can you make a Video on this in detail for benefit of all of us.

Rgds.

Can we use log returns for option prices or simple returns? Please reply

Ответить

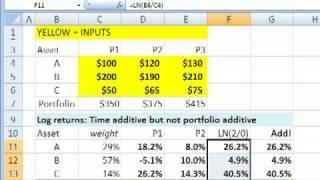

David, this is such a brilliant explanation! Log returns are time additive, which are why they are used more commonly than simple returns that are portfolio additive.

Ответить

What if you want to calculate the average return for a portfolio for every subperiod?

Ответить

Yes, but why? No answer.

Ответить

Side note:

To get the SIMPLE Weighted ROI of LN-ROI you can just Exponentiate the ROI (delogging it):

exp(6.9%)-1 = 7.14% [it's like saying, ok I know what exponential ROI % {i.e. endless compounding interest rate} we have, but what SIMPLE ROI would correspond to it? ]

This is the same as: Log2.71828(69/1000) - 1

Or in Google Sheets, you can alternatively write the following: POW(2.71828, 69/1000) - 1

Additionally:

20%*29%+-5%*57%+30%*14% = 7.15%

while exp(6.9%) - 1 = 7.14%

But how do you find the excess real log return? Do you first find the real log return by subtracting off log inflation from nominal log return… then subtract off log inflation from nominal risk free return… then take the difference between the real log return and the real log risk free return to arrive at excess real log return? Or… do you find excess nominal log return by taking the difference between nominal log return and nominal log risk free return, and then subtracting off log inflation? It’s all very confusing to me.

Ответить

i never knew i could understand this so easily!

Ответить

So question- why is additive an advantage? In what scenario would we want to add (or subtract) returns? Why is that useful?

Ответить

what difference will it make if we assign minus(-) for LN. -LN(P2/P1)

Ответить

why you don't directly say ln a + ln b = ln ab

Ответить

10/10 simple explanation

Ответить

Who else is here from Worldquant University?

Ответить

Log rocks!

Ответить

log(B/A) + log(C/B) = log(B) - log(A) + log(C) - log(B) = log(C/A) makes that 2 period = sum of first two

Ответить

I was lost on eular constanta, log and natural log correlation, to understand its function on finance. Until i found this. Very helpful.

Ответить

zhina!

Ответить

Thanks to WorldQuant University. I enjoyed this simplified illustration

Ответить