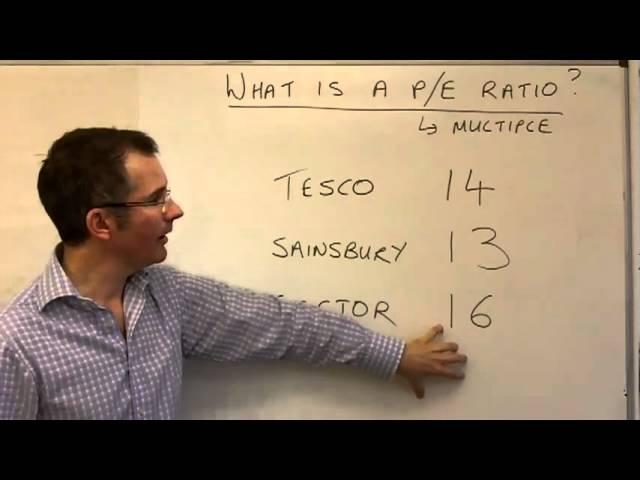

A beginner's guide to p/e ratios - MoneyWeek Investment Tutorials

Комментарии:

RECONNAÎTRE UN NOOB SUR FC 25 🫵

ZORKI - FC 25 Tutoriel FR

sangamjewellerypoint2

sangamjewellerypoint2

Field Day Major

Clerneta

ХБ шоу ГОПНИКИ СОСЕД ШИЗИК АВТОГОНЩИК

Жорик Вартанов

Amish Parents' ASTONISHING Response to Tragedy

Amish America

iOS 16 - 10+ Most Used Features

zollotech

![[Top 5 Most Expensive Hotels in the World 2025 | Ultimate Luxury Travel Destinations”] [Top 5 Most Expensive Hotels in the World 2025 | Ultimate Luxury Travel Destinations”]](https://ruvideo.cc/img/upload/SURDeXlMOHBKVlg.jpg)