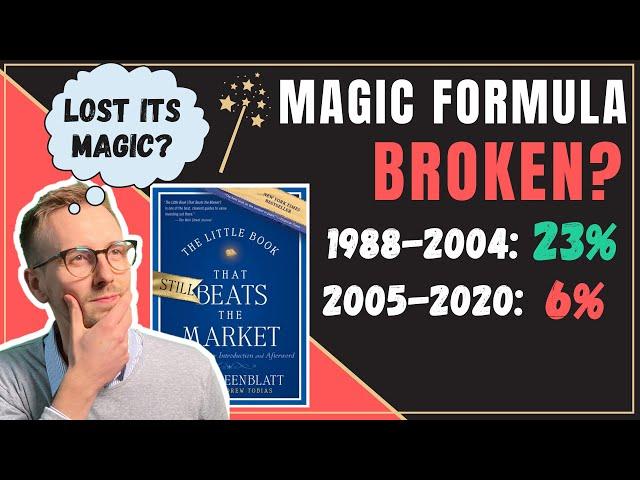

Magic Formula Investing Broken? Why Magic Formula Investing Has Lost Its Magic! (Greenblatt)

Комментарии:

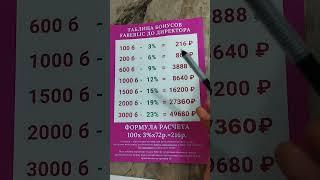

Маркетинг план компании ФАБЕРЛИК

Седа Саламова Директор Фаберлик ♥️

Purani Delhi ki Deg Waali Famous Chicken Biryani

Zaika Dilli 6

Gor's Perfectly Cut Screams 40 by Troliass REACTION

Gor's Meme Reactions

2Pac - What's Next? • (2024)

Enter Makaveli

Nitro Deck Plus for the Nintendo Switch

Retro Video Game Pickups

I Tried Every Olympic Sport In 1 Week - Day 5

Lachlan Earnshaw

Маркетинг ПЛАН Фаберлик простыми словами! За что Faberlic платит деньги? #СетевойЛайфхак

Антон и Алена Юртаевы - Домашний Бизнес

The Key to Dynamic Relationships: Avoiding Common Mistakes with Alexandra Stockwell, MD

Alexandra Stockwell, MD | Intimacy Coach