How to Boost Your Tax Refund SAFELY - Tax Expert's 10 Tips

Комментарии:

How to Boost Your Tax Refund SAFELY - Tax Expert's 10 Tips

Karlton Dennis

Don’t wake the ghost #shorts

Ayoehh

[대한상공회의소] ESG 경영 소개 포스코편

리더뉴 | RE THE NEW

Zombie Army Vs Warden (Minecraft Animation)

Cubus Maximus

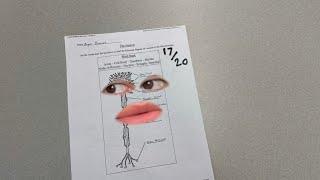

Life of A School Test

jimenezaj

The mt everest journey 2023 @tailansavalan

Everestexpedi

it didn't work out for a reason...

ronxhall

Being Dumb with my Friends

CringyGull

![[대한상공회의소] ESG 경영 소개 포스코편 [대한상공회의소] ESG 경영 소개 포스코편](https://ruvideo.cc/img/upload/UVRqdDR1cjk4djM.jpg)