Комментарии:

Whole canada is unreasonable

Ответить

love your hypothetical example bring them all

Ответить

Barbados company needed some economic substance

Ответить

Great chanel. Please go more onto depth

Ответить

your handwriting is beautiful.

Ответить

So you hire a few employees in Barbados at low wages and they’re in the clear?

Ответить

Incorporation of companies/corporation are to be REGISTERED as Domestic or International companies and corporation, as Licensees, Franchisors-Owners and Franchisees where PATENTS, TRADEMARKS, COPYRIGHTS and ALL TAXES Classifications and REGISTRATIONS are Implemented amongst countries, where the businesses locations amongst countries are DECLARED addresses as SMES in businesses are Worldwide, SMALL, MEDIUM, ENTERPRISE, NON-REVERSE or FLIP, since it is also DECLARED with respective LGU units for requirements and permits, in all classifications for businesses are to APPLY, Reflected and applied in the books of the CORPORATION, respective Incorporators and its Articles.

Ответить

Absolutely clear and onesided pristine case of Transfer pricing gone wrong. No one well informed within the TP community right now will be doing these type of insane manauvers. Dempe functions are being scrutinized deeply. Pillar 1 amount B streamlined process is not being applied yet, but if does it will cut off all these type of simple distribution structures.

Ответить

This is such a useful channel - do you give tax advising as well? I need you brains as an entrepreneur in EU.

Ответить

bro ur handwriting is so tidy lol

my handwriting is barely readable

I've been doing this for ages 😅😅😅

Ответить

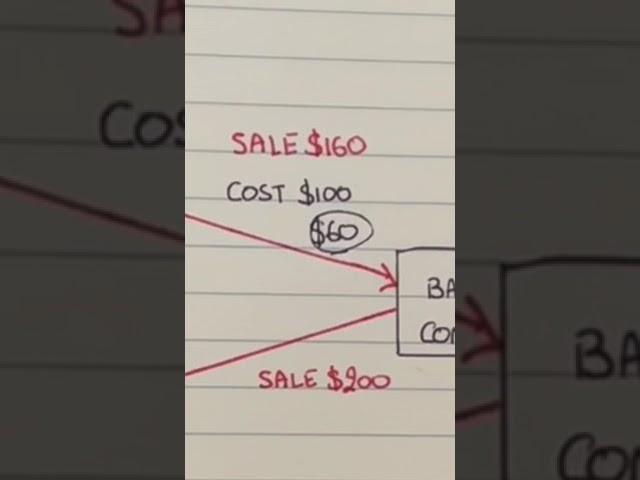

No. First mistake in your calculation is that you must be owner of all 3 companies involved. Only then you can fully exploit Barbados company.

Your manufacturing value of goods in Canada is 100$, you sell that for 120$, so Canada will tax 20$, Barbados company is selling your goods to US company for 200$. US company is selling that on US market for 220$. US tax 20$ of profit, Barbados company is taxable for 80$ at 2.5%, that's 2$, so you have 78$ tax free.

Better is to exclude Canada and use China with which Barbados have DTA in force. Canadian authorities can see only contracts between Canadian and Barbados, but not between Barbados and US, so they can't know for which price goods are sold and where.

Also Canadian jurisdiction ends at its borders, they can't have insight in company register of other countries.

No way I was thinking about this the other day cheers bro

Ответить

The profit is 100% reasonable, let the company make their money

Ответить

Can you do a long-form video on this and explain the correct way to structure this

Ответить

Seems kinda unfair. What gives the Canadian govt any right over one man’s private property and the way they sell it ?

The way I see it , he’s not harming anyone that way.

Just saving on taxes.

Using his private corporations which is “NOT” listed on the Canadian stock exchange.

Also , in a totally different jurisdiction.

So it's better to sell it from the Barbados company 100% instead of splitting

Ответить

SOooo 🤔 what's the right way to do it??

Obviously just asking for a friend🙄