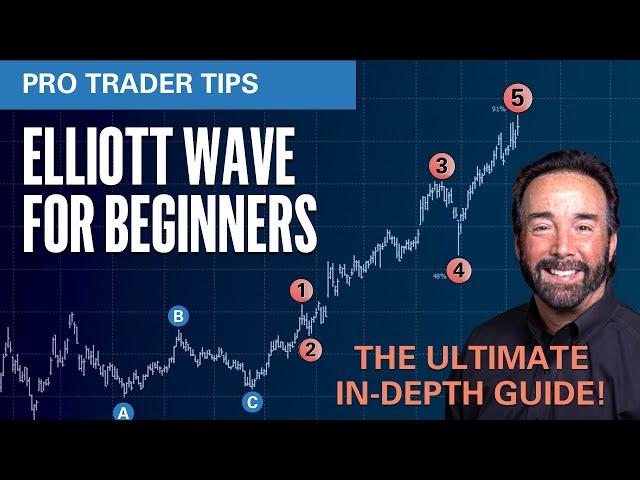

Elliott Wave Theory for Beginners | ULTIMATE In-Depth Guide!

Комментарии:

I believe in the basic Elliott Wave Principle (the 5 + 3) pattern that can be seen in "some" price patterns. But I think where Elliott Wave goes off track is when it dictates that stock market prices MUST adhere to all the added rules and predictions for motive and corrective forces. Perhaps back in Elliott's day (1938 - 1939) when the stock market was simpler or even when Robert Prechter made the Elliott Wave Theory popular (1979) such a detailed theory could be implemented. But in today's market where many MILLIONS of traders are participating and most are using computer algorithms for multi-second, in and out trading, then you just cannot expect precision of stock price movement. There are just too many people trading for the short term. In the Old Days, I suspect trading was more for the long term. It used to be called "investing" rather than today's market where trading is called "speculation". But this is an excellent video to explain the principles. Anyone who has tried to read the Robert Prechter books and stay awake will understand this video a lot easier. UPDATE - yet as I look at another of your videos as on the S&P, you have beautifully marked all the predicted upward and retracement lines. Did you notice that even within your major upward movement that there was that 5 + 3 pattern, too? I've got to check out all the rest of your videos.

Ответить

This is way too complex

Ответить

Excellent Video, Love the way you explain difficult concepts in such an easy to understand way! On a sideways move once you determine whether it is Bullish or Bearish can you rely on that as confirmation of the direction of the breakout to come?

Ответить

Stocks go up and stocks go down. And you can make a zig zag to look like you knew it was going up or down.

Got it!

Thanks for the simple explanation of the Elliot Waves. Easy to understand. If you can combine it with charts & explain how to label the wave patterns it will be very much helpful. Thanks once again for the beautiful presentation and explanation.

Ответить

perfect. thanks alot sir

Ответить

big big thanks

Ответить

This is quite an interesting and informative video.

Are you the type of person who will read as much as possible about potential investments and ask questions about them? If so, maybe you don't need investment advice. But if you're busy with work, kids or other responsibilities, or feel like you don't know enough about investing on your own, then you may benefit from professional investment advice.

Thanks 👍

Ответить

This is by far the simplest elliot waves pattern explained for beginners. Thank you so much

Ответить

Thank you for writing a script! Listening to people say "ummm" for an hour cause they never considered how they were going to explain it gets tiring. Thanks so much!

Ответить

awesome video.. do you recommend any mt4 indicator that follows your knowlege of elliot wave?

Ответить

Thanks a lot. How do we identify the turning points that defines the start/finish of a wave? Think this is important for apply all the theory into practice. Thank you!

Ответить

Idiot wave, for gullibles!

Ответить

Looking at Bitcoin(BLX) on the macro. What does Elliot see?

Ответить

thank you for this video

Ответить

Sir, Do you use or recommend auto support/resistance indicator & if so what time frame S/R levels to execute intraday(but not day trading) orders in forex. For What time frames S/R-I would think it should be 1H or 4H time frame S/R. One hour is short enough but still meaning full enough data-and it it better to use 15 minute chart to watch price action at A given S/R(BECAUSE 5 MINUTE CANDLES GIVE TOO MANY FALSE SIGNALS) ?. If S/R level appears on more than one time frame, that level becomes even more RELAVANT.? Say daily trend was up overall(prices marked up now) but daily candle now is down over last 2 days or so--- then look for resistance on 4H chart & go short-here 4H resistance level would be A good level (It has decent load of useful data-even institutions/bog boys) Sir, I seek your comments/wisdom. And I Thank you.

Have you heard of the coin flip strategy? It's even better than Elliot waves and it's so easy. Basically you just flip a coin. If it's head, you short. If it's tails, you go long. This strategy beats 90% of traders out there

Ответить

Any indicators for Elliot waves to defect it on Trading view automatically

Ответить

Good

Ответить

Comprehensive video have ever watch

Ответить

Really educational video

Ответить

Elliot wave always seemed so difficult. This is great

Ответить

Perhaps Fibonacci also comes in handy for the "time" component... 🤔

Ответить

I need more on these topics please! Connectors, 1212’s, wxy’s, and when and where they all happen in the cycle. Also how yo use rsi divergence with determining what wave we’re in or anything rsi can tell us. Thank you!

Ответить

is xrp in a eliot wave?

Ответить

excellent video .

Thanks

Fractal

Ответить

Thank you Sir

Ответить

Really educational video on EW and also well explained, thank you. But I would recommend you to use more a common chart Design next time. The charts you are using makes it hard for the watcher be sure they have identified the right dip or high of the pattern. Beginers will use the tradittionl green red candle sticks so it would be easier to rely on.

Ответить

Any relevant books on the matter?

Ответить

<looking closely at the longer-term market may put bitcoin’s current price difficulties in perspective, but it offers little help in predicting its future trajectory. Analysts remain divided over whether this is the end of a so-called “dead cat bounce” within a bear market or if it is just a blip on the way to new all-time highs in 2021. Either way, the price fluctuations are to be expected, that is why it is reasonable to trade with the guidance of an expert. Since October last till now I have accumulated up to 12 BTC with exclusive tips from Boaz Colson.

Ответить

I love EW and when I discovered it (gee that sounds like those spam posts we see online) my understanding of the stock market forever changed. To think that I started trading crypto as I was learning EW, on dailies....oh...4 hr sleep per day routine...unsustainable. Swing trading at best and long term investing is what I'm about in the end. Waiting for Rob to set up an account where he shows us trades in real time and takes risks with us for learning sake based on what he knows. Rob? :)

Ответить

Thank You

Ответить

who is this guy presenting if you don't mind? I want to learn more about him.

Ответить

Where have you been all my life? 😭

Thank you sir. God bless you

Outstanding !!! Thank you Sir and God bless you … Davide

Ответить

Simply outstanding explanations!

Ответить

At 19.00 mins its mentioned the Fib levels for expanding based on 1,2 waves etc. Where are those rules published ? eg the retracement for extrapolating out wave 5 from initial waves

Ответить

This is great! I'm 3 months in to Elliot Wave, and I now realize how little I actually know about technical analysis! Lol. I mean, wow! The rabbit hole is deep. I feel like elliot wave, fibonacci, and good risk management are the real life "infinite money glitch". Lol. Thanks Man!!

Ответить

Leonardo Pisano. A few hundred years later a historian gave him the moniker "son of Bonaci"

Ответить

Can there be 6 waves or more?

Ответить

Something clicked. I always thought this was so hard to understand but take little bits at a time 🔥🔥🔥

Ответить

great stuff. thanks

Ответить

Nice video i ever seen about elliot principle, thanks dear...........

Ответить

Emotions? Lunar cycle trading.

Ответить