Option Butterfly Strategy – What is a Butterfly Spread

Комментарии:

Why would you want lower implied volatility with a short butterfly, when you want the price to move for max profitability?

Ответить

Thank you, James Bond supervillain. :) Just joking. Say hi to the white kitty.

Ответить

Very good video, great info!! Thanks!

Ответить

Amazing ❤️

Ответить

Great explanation, I copied down that Greek chart, thank you very much!

Ответить

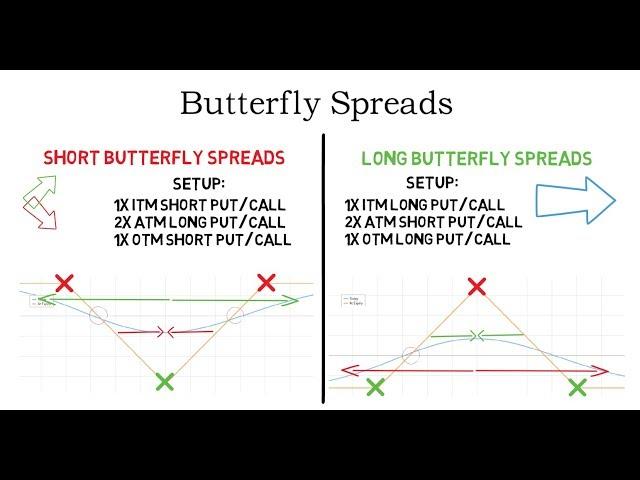

I think this tutorial is wrong! Are you sure that you haven't switched the strategies? The graphs look like they have been switched!

Ответить

Very informative, nice video!

Ответить

What is the difference of a regular butterfly, compared to an Ironfly strategy?

Ответить

Is there no difference if you use Puts vs Calls on the Butterfly?

Ответить

Great video. It would be helpful if you actually wrote which options that you’re buying and selling as you explained it.

Ответить

Put this at 1.25 speed. You'll thank me later

Ответить

Great. Thanks.

Ответить

Thanks

Ответить

very nice simple explanations others make it very complicated

Ответить

Agree with other comments..your channel is the best at explaining options

Ответить

THANK YOU!

Ответить

Super

Ответить

So i just setup a butterfly Call option, says thgat Debt is 0 and max loss is 0 with a max profit of 100. i dont understand. so i can place this calll and have nothing to loose but only gain 100 ?

Ответить

Perfectly explained. Thank you. A tip to viewers - watch at 1.25-1.5x speed haha

Ответить

clear, concise verbage with excellent diagrams

Ответить

Very informative and great video! I like this class and feel is the best for the Butterfly!

Ответить

I just noticed this video is done in 2017. But I wached so many videos and I believe this is still the best video for Butterfly!

Ответить

Good job man, thank u

Ответить

Good discussion. Takes a lot of capital to open a long butterfly spread. Not sure about a short butterfly spread.

Ответить

Wow, your explantion is incredible. Just one point on long butterfly is that is it the same as the Iron butterfly, i have traded a couple recently the advantage of them is that they are very cheap so, and your losses are very small if you lose but if you only stay a few days 5/10 you will most likely win, and since you bet very little it is easy to double your money by making little gains.

I appreciate your in depth work. No one explains it the way you just did, thank you 👏👏

The best course on butterfly. Glad to have actually seen your video carefully today.

Ответить

Your simply awesome

Ответить

I did try this Long butterfly strategy.. but found difficult to exit it? What's the best way to exit from trade for butterfly?

Ответить

Do you need collateral (100 shares or money to buy 100 shares) for this strategy?

Ответить

Really Nice, simple and informative video, so you suggest in in short butterfly, one short put in the money , 2 long put at money and one more short put out of the MONEY, do you also trained or worked for daily basis tips and if so what are you charges, thanks again. Farhan

Ответить

Great video, best explanation on butterfly i have seen, clear and concise without any information overload. I like how all the applicable parts are covered such as entering a trade base on IV rank and also explanation of the greeks to help us in evaluating our position. Keep up the good work

Ответить

A very, very good video. Especially showing the difference between long and short butterfly spreads.

Ответить

Excellent , could not have been any better. U r a kind hearted genius.

Ответить

It doesn´t work. You will never find spreads with the same premium, so the graphic will not be symmetric. I simulated this with many stocks. This is somehow a misleading video.

Ответить

very helpfull video how to open butterflys but i have yet to see a actual video how to close these butterflys?????

Ответить

I guess im an idiot. i watched this entire video and paid attention and i still dont understand what a butterfly is.

Ответить

Nice introduction

Ответить

Awesome explanation I have a question how would a out of the money long butterfly work because when backtested on an options backtester it seems to do quite well over many different markets

Ответить

GREAT video the best course on butterfly. I have a quest there if that is the cases I can Long or Short the butterfly on Call or put , How can I choose to do the Call butterfly or put butterly

Ответить

Great video. I have a question, why would you prefer short butterfly spreads while in another video you would prefer short iron condor, since from the P/L graph I can see short butterfly works so similar as long iron condor . I would appreciate your reply.

Ответить

Does the profit chart look the same whether you do short call butterfly spread or short put butterfly spread?

Because I am assuming the profit profile looks the same since you never touched on it in the video.

And the same goes for Long Butterfly spreads. Does the chart look the same whether you do a long put butterfly spread or long call butterfly spread?

Eccellent. 🎉🎉🎉

Ответить

this was very educational for me

Ответить

Odd question but did you use doodly to make this video?

Ответить

thank you very much. I struggle to understand how to use this strategy in O DTR or 1 DTE. What I see on the net is unclear. Maybe you have a video for that?

Ответить

This is wrong! The short butterfly you are paid so the point should be above the zero line. the graphs are wrong!

Ответить

I use this regardless, as I don’t study the market. Example: choose highly active stock - Tesla. BTO 2ATM calls, Sell 1 each 5 pts out on both sides. 4 weeks out. Place trade. Set close at 40% profit. Genius.

Ответить

Thank you so much for explaining so clearly. Not the video and i sincerely appreciate the effort you put in.

Ответить