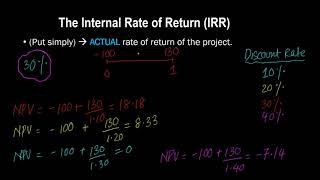

Internal Rate of Return (IRR): The Fundamental Concept | Part 1 of 2

In this video, I explain the concept of Internal Rate of Return and how it can be used to decide whether or not to accept an investment prospect. Students often do not understand why, from a definition standpoint, IRR is the discount rate that makes NPV = 0. I explain that connectio in this video, and then also explain how the IRR decision rule is related to the NPV decision rule. In other words, I explain how a project with positive NPV will generally (NOT always) also have an IRR that is greater than the discount rate (or the required rate of return).

The investment prospect considered in this example is simplistic. I recommend that students also view "Part 2" of this video for a more comprehensive understanding of how to calculate IRR and make investment decisions based on it.

ABOUT ME:

My name is Atif Ikram. I am a Clinical Professor of Finance at Arizona State University, where I teach courses in Corporate Finance, Personal Finance, Real Estate Finance and Investments (https://wpcarey.asu.edu/people/profile/810040).

Follow me on LinkedIn:

https://www.linkedin.com/in/professorikram/

Follow me on Facebook:

https://www.facebook.com/ikramteaches/

Follow me on Instagram:

https://www.instagram.com/professorikram/

The investment prospect considered in this example is simplistic. I recommend that students also view "Part 2" of this video for a more comprehensive understanding of how to calculate IRR and make investment decisions based on it.

ABOUT ME:

My name is Atif Ikram. I am a Clinical Professor of Finance at Arizona State University, where I teach courses in Corporate Finance, Personal Finance, Real Estate Finance and Investments (https://wpcarey.asu.edu/people/profile/810040).

Follow me on LinkedIn:

https://www.linkedin.com/in/professorikram/

Follow me on Facebook:

https://www.facebook.com/ikramteaches/

Follow me on Instagram:

https://www.instagram.com/professorikram/

Тэги:

#NPV_and_Other_Investment_Rules #Investment_Rules #Ross_Westerfield_Jaffe_Jordan #RWJJ #RWJJ_Chapter_5 #Chapter_5 #Corporate_Finance #Capital_Budgeting #Investment_Decision #Internal_Rate_of_Return #IRR #IRR_Decision_Rule #IRR_Discount_Rate #NPV_=_0 #Zero_NPV #IRR_NPV_link #IRR_NPV_Relationship #Financial_ManagementКомментарии:

FAT Ki Lagadena Watt with this chaat #bharatzkitchen #food #recipe #ramzan

Bharatzkitchen Shorts

NUEVA NISSAN X-TRAIL 2023 - ¿Vale la Pena? - Velocidad Total

Velocidad Total

Lasya + Manju | Pre-wedding Teaser | Moment Makers

Moment Makers

Отделение пластической хирургии сети клиник «Столица»

Сеть клиник Столица Москва

What causes Japanese people to work overtime?

George Japan

Paris vlog

Rosesarerosie