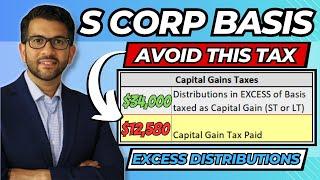

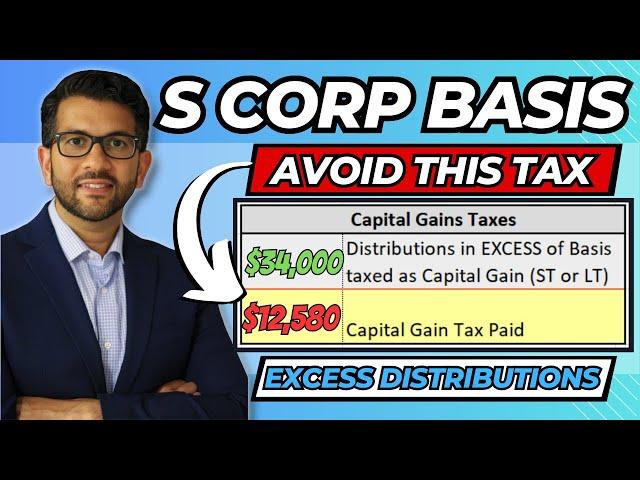

S Corp Basis Explanation | Distributions in EXCESS of Basis

Комментарии:

S Corp Basis Explanation | Distributions in EXCESS of Basis

Navi Maraj, CPA

Unique Things to do in Venice, Italy (ULTIMATE Guide) | Walking Tour

The Travelholic's World

ASMR 1 Hour Of Facts About DINOSAURS (Whispered)

AllSorts ASMR

Ohhh I’m so close #apexlegends

UnstainedRobin

RF - Saga vs Lune for GC1v1Tournament

TheCanadianRF

Vremea de astazi 25 Martie 2025 Ora 19

Vremea Pro