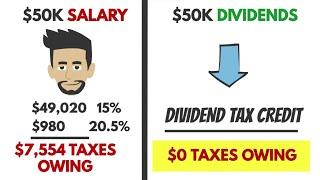

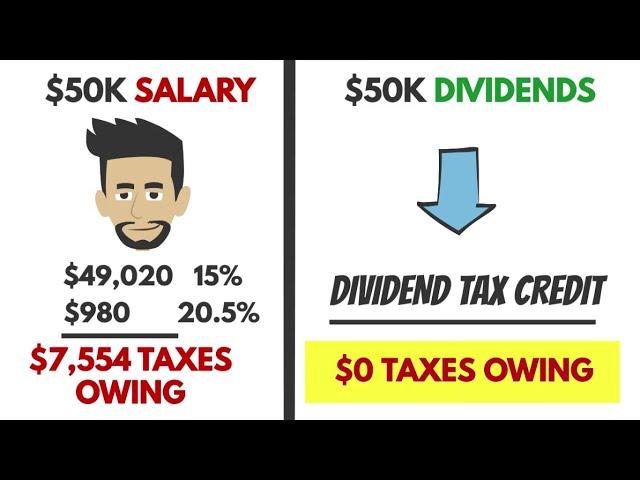

Episode 2: How Is Income Taxed in Canada

Комментарии:

The examples in the video are basic and do not include deductions and credits you may be eligible for. However, they give you a general understanding of how taxes in work in Canada. We will cover more detailed breakdowns of taxation in upcoming videos.

Ответить

If a company pays dividends but are classified as capital gains. How does that work? Do you claim the dividend as capital gains or as dividends?

Ответить

Hi there, I am looking to get into consulting business for large corporate sales with big commissions contract. No salaries straight up commission ranging from 500K to 2 Millions + CAD what is the best structure to minimize the tax burden? Any suggestions will be greatly appreciated! Thank you

Ответить

lol you work more and pay more tax than the guy who makes money passively from capital gains and dividends, it should be the other way around, this is why the rich gets richer, they get rid of their working income so they pay less tax, they get gifted money from their company or get compensated with shares.

Ответить

thanks for taking the time to make these informative videos!! really appreciate it. :)

Ответить