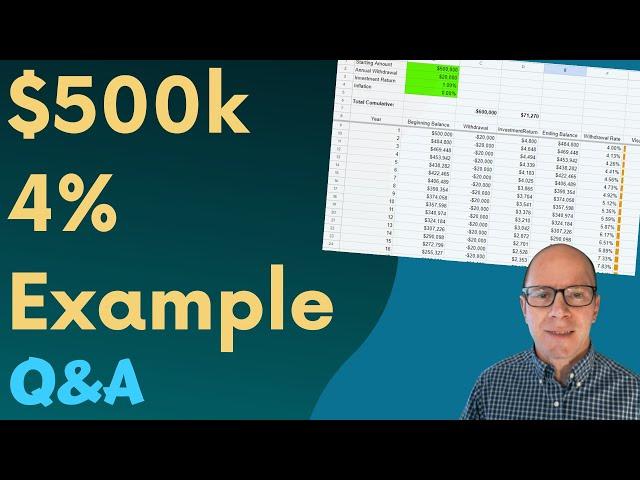

Q&A: Spend $500k at a 4% Rate (And Much More) Example

If you have $500k saved for retirement, the so-called “4% Rule” says you can spend $20,000 per year. A viewer asks the following: Over 30 years, that adds up to a total of $600,000. So, how do you get $600k out of $500k?

🌞 Subscribe to this channel (it's free): https://www.youtube.com/channel/UCFFNzgGX4UyGQk12KL38I1Q?sub_confirmation=1

Get free retirement planning resources: https://approachfp.com/2-downloads/

🔑 9 Keys to Retirement Planning

🐢 6 Safest Investments

-------------------------------------------- WANT TO ASK A QUESTION FOR A FUTURE VIDEO?

The two best ways to do that:

1) Submit the question here 👉 https://forms.gle/JqhUZYX6646sWToq9 or

2) You may type the question in the comments (note that comments may be visible to the public)

Important: Never share sensitive/private information (including, but not limited to: account numbers, SSN, date of birth, address, phone number, usernames or passwords, etc.) in those questions. Not all questions will be answered. Your question and details may be shown and discussed publicly.

--------------------------------------------

We’ll address that question, and more importantly, fiddle around with some numbers to illustrate some essential concepts for retirement income planning.

We’ll look at how earnings on your retirement savings can help stretch your assets. Plus, we’ll see how inflation, market crashes, and adjustments to your spending might look in a simplified model.

The amount you withdraw from savings can supplement income from Social Security and other sources. But it’s important for that money to last for the rest of your life. The amount you spend affects how long your money will last, but investment returns and inflation are also important.

Learn about working with me at https://approachfp.com/

✔️ Flat-fee options

✔️ One-time projects available

✔️ Investment advice (optional)

Related Videos:

Retirement Spending Reality: https://www.youtube.com/watch?v=dzVep2dJQDw

Do Rules of Thumb Work? https://www.youtube.com/watch?v=lZe2iEsguzk

CHAPTERS:

0:38 Question on Spending 4% of $500,000

1:56 Add Some Earnings

4:28 Market Losses and Spending Adjustments

7:04 Spending Patterns (Go-Go, Slow-Go, No-Go & Spending Smile)

Justin Pritchard, CFP® is a fee-only fiduciary advisor who can work with clients in Colorado and most other states.

IMPORTANT:

It's impossible to cover everything you need to know in a video like this. The only thing that's certain is that you need more information than this. Always consult with a CPA before making decisions or filing a tax return. This is general information and entertainment, and is not created with any knowledge of your circumstances. As a result, you need to speak with your own tax, legal, and financial professional who is familiar with your details. This video is not a substitute for individualized, personal advice. Please verify with your plan administrator when employer plans are involved. This information may have errors or omissions, may be outdated, or may not be applicable to your situation. Investments are not bank guaranteed and may lose money. Opinions expressed are as of the date of the recording and are subject to change. “Likes” should not be considered a positive reflection of the investment advisory services offered by Approach Financial, Inc. The Comments section contains opinions that are not the opinions of Approach Financial, Inc., and you should view all comments with skepticism. Approach Financial, Inc. is registered as an investment adviser in the state of Colorado and is licensed to do business in any state where registered or otherwise exempt from registration.

🌞 Subscribe to this channel (it's free): https://www.youtube.com/channel/UCFFNzgGX4UyGQk12KL38I1Q?sub_confirmation=1

Get free retirement planning resources: https://approachfp.com/2-downloads/

🔑 9 Keys to Retirement Planning

🐢 6 Safest Investments

-------------------------------------------- WANT TO ASK A QUESTION FOR A FUTURE VIDEO?

The two best ways to do that:

1) Submit the question here 👉 https://forms.gle/JqhUZYX6646sWToq9 or

2) You may type the question in the comments (note that comments may be visible to the public)

Important: Never share sensitive/private information (including, but not limited to: account numbers, SSN, date of birth, address, phone number, usernames or passwords, etc.) in those questions. Not all questions will be answered. Your question and details may be shown and discussed publicly.

--------------------------------------------

We’ll address that question, and more importantly, fiddle around with some numbers to illustrate some essential concepts for retirement income planning.

We’ll look at how earnings on your retirement savings can help stretch your assets. Plus, we’ll see how inflation, market crashes, and adjustments to your spending might look in a simplified model.

The amount you withdraw from savings can supplement income from Social Security and other sources. But it’s important for that money to last for the rest of your life. The amount you spend affects how long your money will last, but investment returns and inflation are also important.

Learn about working with me at https://approachfp.com/

✔️ Flat-fee options

✔️ One-time projects available

✔️ Investment advice (optional)

Related Videos:

Retirement Spending Reality: https://www.youtube.com/watch?v=dzVep2dJQDw

Do Rules of Thumb Work? https://www.youtube.com/watch?v=lZe2iEsguzk

CHAPTERS:

0:38 Question on Spending 4% of $500,000

1:56 Add Some Earnings

4:28 Market Losses and Spending Adjustments

7:04 Spending Patterns (Go-Go, Slow-Go, No-Go & Spending Smile)

Justin Pritchard, CFP® is a fee-only fiduciary advisor who can work with clients in Colorado and most other states.

IMPORTANT:

It's impossible to cover everything you need to know in a video like this. The only thing that's certain is that you need more information than this. Always consult with a CPA before making decisions or filing a tax return. This is general information and entertainment, and is not created with any knowledge of your circumstances. As a result, you need to speak with your own tax, legal, and financial professional who is familiar with your details. This video is not a substitute for individualized, personal advice. Please verify with your plan administrator when employer plans are involved. This information may have errors or omissions, may be outdated, or may not be applicable to your situation. Investments are not bank guaranteed and may lose money. Opinions expressed are as of the date of the recording and are subject to change. “Likes” should not be considered a positive reflection of the investment advisory services offered by Approach Financial, Inc. The Comments section contains opinions that are not the opinions of Approach Financial, Inc., and you should view all comments with skepticism. Approach Financial, Inc. is registered as an investment adviser in the state of Colorado and is licensed to do business in any state where registered or otherwise exempt from registration.

Тэги:

#4%_rule #retirement_spending #retirement_planning #financial_planning #500k_retirement #guardrails #cfp #financial_advisor #investing_in_retirement #adjust_spending #market_losses #retirement_reality #retirees #how_to_retireКомментарии:

Q&A: Spend $500k at a 4% Rate (And Much More) Example

Justin Pritchard, CFP® on Retirement Planning

100% гребенной меринос на любое изделие почему его так любят вязальщицы арт WB 241334097 #вязание

SKY WOOL стоковая пряжа из Италии

Secret Group that Runs the World - SCP O5 Council Explained (SCP Animation)

SCP Explained - Story & Animation

Turn $80k into $10 Million with Token Metrics?

Token Metrics Clips

Евгений Гущин. Дача. Инсценированные страницы повести "По сходной цене"

Советское радио. ГОСТЕЛЕРАДИОФОНД

Mastering Dungeons Goes Indie, D&D on ESPN, D&D Kickstarter Spotlights – Lazy D&D Talk Show

Sly Flourish – The Lazy Dungeon Master

Birthday Gift| NS CREATIONS|

Ns Creations

TYS vs. Al'Akir 10 man heroic

bladedemon81