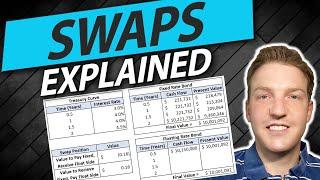

Interest Rate Swaps Explained | Example Calculation

Комментарии:

Interest Rate Swaps Explained | Example Calculation

Ryan O'Connell, CFA, FRM

Take a look at the world's largest Giant River Dredging Machine 1

Life Motivation 16

Digital Skizzieren - Wie man am PC Skizzen erstellt und diese detailliert | Digital zeichnen Lernen

DrawTut - Zeichnen lernen und Tutorials

鍾培生Vs林作 培生擂台:無敵盃2021 WE ARE CHAMPS 2021

鍾培生Derek Cheung

【鈦自在保健醫材】多功能枕 #三角枕 #體適能 #機能枕 #復健

鈦自在全方位養護《班森全人養護師》