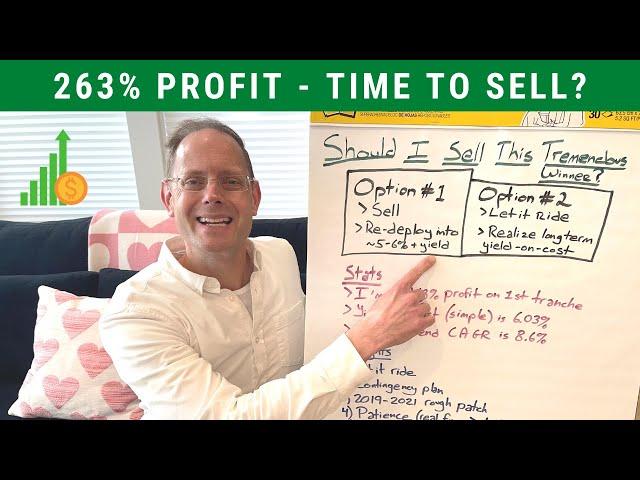

Should I Immediately Sell This Popular Dividend Stock?

Комментарии:

High yield on cost and still dividend growth with nice CAGR. It is an example of value and dividend growth investing, I would not sell it, keep nice yield and enjoy cash flow

Ответить

I ❤ your videos ian

Ответить

thnx

Ответить

Why don't you sell CAT and buy the smaller companies such as ALG and AGCO?

Ответить

Hey video was very interesting, but being an editor i can confidently say there's some things which can be improved like titles are not discoverable, the thumbnails and content could be made more engaging postproduction.

That is why i have edited one video for you completely free, So pls share a touchpoint so that i can share with you..and if you liked it then we can talk about future aspects)

I've always liked CAT I think they are going to do well with AI same with John Deere

Ответить

Hey sir I’m a little freaked out it looks like the dollar is getting very inflated should we be concerned about these companies crashing ? I know you did your research, and these companies go through recessions , but a little knowledge will put my mind at ease

Ответить

Tax considerations are also important. Instead of paying a capital gains tax and having less principal to reinvest, you are letting the whole value of your current holding to continue to compound.

Great video. Thanks!

🗽 The only thing we know is what is now value.

What we never know is, is that business also in the future an excellent business... but odds are good.

.

🗽 I would not sell a winner. I would be happy to have bought a winner.

DISCLOSURE: I am not yet long Caterpillar

.

Ian, I would wait until the upcoming dividend increase to decide. Hopefully its a massive increase.

Ответить

Thank you for all the time you put into your videos. Can you do a video on the cyclical industrial stocks like leggett and Platt/3M. They took a similar path in 2000 late in the fed hiking cycle. They are still holding strong on their dividend but stock price has tanked.

Ответить

If considering selling it, you could sell covered calls a decent amount higher , and collect more income, and if the calls hit, well there ya go.

Ответить

Ian you could consider dollar cost averaging OUT of CAT.

Ответить

Hey Ian,

I’ve been following your videos for a while. I’m a fellow runner by the way and am a big fan of your channel – really appreciate the content you put out. I am long many of the stocks you talk about such as ABBV (I have your videos in part to thank for getting into it when it was below $100), HON, HD, etc.

While I do not short stocks I have been a CAT bear for many years (and have been wrong so far) and would never buy the stock. My reasoning is in part due to being very bullish on the aerospace industry and more specifically on flying car stocks in the coming decade or two. My theory is that just as Tesla disrupted oil and gas companies such as XOM and CVX, flying car companies such as ACHR and JOBY will disrupt the construction industry and stocks like Caterpillar and John Deere – less need for road construction when you need less roads and the roads you have need to be repaved far less often.

I’m really curious what your thoughts are on the topic of innovation and disruption. I’m generally more of a dividend stock investor like you are but sometimes I can’t help adding a few speculative positions to my portfolio if I think I spot a major secular growth theme.

Neither #1 nor #2.

The approach that has worked well for me, is to sell a portion of the winners to redeploy that capital into undervalued companies. This works especially well for cyclical companies like CAT (and TSLA). If it keeps going up, great! I still own most of my position. If it drops, then hey at least I sold 20% to 40% at a better price. I also look for losers in my taxable account that I can sell for a loss to offset capital gains and even some ordinary income (watch out for the wash sale rule, and also consider ex-div dates, and long-term is preferable to short term).

For example, in December I sold some losers. In January I realized some gains and 31 days after the sale I started buying back those sold positions, prioritizing those with the first ex-div dates and which looked to be recovering. Some times I'll use cash secured PUTs to buy and covered CALLs to sell but often I operate on narrow windows between important dates.

Long TSLA but (sadly) no position in CAT

No way would I sell CAT w/ 6% y..o.c. Current yield is irrelevant in this case. Trying to find a 6% current yield with the low risk CAT has would be tough. Why create the risk? And w/ 8% CAGR you’ll probably be at 12% y.o.c. in 7 years. This is a perfect example of what you want out of dividend stocks for the long term.

Ответить

You have a 3rd option. if you're up by 100% or more, sell half to take what you put in off the table.

Ответить

Thank you for the new dividend video update Ian! This was very informative.

Ответить

I remember the videos in the back yard! Can't believe how long it's been. You changed my life, I appreciate you, good day!

Ответить

Great video Mr. Cian. I've been buying Pfizer on a montly basis since July 2023, I'm down 11.41% and happy because I can keep buying this solid stock at a discounted price. Yes, keep Cat and buy more PFE and O, also keep on working out; your health is the best investment!

Ответить

HI Ian, this brillliant video piqued my interest once again (after having lapsed watching your videos for a bit) because you describe exactly my calamity. Yield on cost is all very well, but I'm very near to retirement and am looking for the biggest bang for my buck. So, I would (at this stage in my career) sell CAT and go for Realty Income and Pfizer.

Ответить

How about sell enough to get your original cost out after paying taxes on the shares sold and keep the difference? You can redeploy your investment capital and the shares you keep are the markets money and are all "free". By my calculations, you could sell 35%, pay the tax on that sale and get your original cost out. 65% remaining would be the "markets money" continuing to grow and pay a growing dividend while deferring the tax on the appreciated stock until you choose to sell but until then, you got your original cost out.

Ответить

You planted a great dividend tree. Enjoy the fruits every quarter provides. This is a longterm winner.

Ответить

How wonderful to see another wise video from you, Ian! Like you, I've been looking at my low yielders...sold Apple, holding HRL, AVGO, and NEE. But as I get into my 40s, I value higher yield more. So a nice sweet spot would be PRU with 4.5% yield and I think 6% growth dividend. I've also been watching LYB for a potential sweet spot dividend payer. It's great to hear that you change your views over time and do what makes you happy! Enjoy the journey!!

Ответить

OPTION 2

Ответить

Redeploy into Realty income which has come back down to a great price!

Ответить

3m?

Ответить

Thx Ian. I appreciate your YT content & I remember the backyard vids!

Ответить

Buffet doesn't sell winners. I look for total growth, dividends + cap appreciation.

Ответить

I made my wife watch this with me. She thought you were going to sell ABBV.....lol. Why don't you average out, and into something else over the year? I've been going more the bitcoin route for 2024 including IBIT, RIOT, and BTBT. Best wishes Ian. Thank you for posting. CAT is close to a 52 week high. Sell a 1/4.

Ответить

I love holding dividend paying stocks. But when the equity runs up so much, I would certainly consider selling and redeployment into a new position where the cash flow is higher than the stock I sold.

Ответить

Honestly, I would HOLD if i were you. I have a very similar situation with Parker-Hannifin (PH). I've held PH for over 10 years; at times i trimmed my holdings because they were hitting "records" - and everytime, i regretted it; and i later bought back in. If you were to compare PH and CAT you would see very similar trends over 10 or more years - except PH recently surged over the last 12 months - my point is that just because CAT has hit records it doesn't mean they are done. Also, US Infrastructure spending still has a long way to go.

Ответить

What about using the stocks as collateral backed loan instead selling and paying capital gains tax?

Ответить

let it ride

Ответить

I've been wondering the same thing Ian, I don't have much exposure to it though.

Ответить

I have watched your videos from the PPC lectures.

Ответить

Ian…doesn’t have to be zero sum…own both ( CAT and PFE). Show you kids when cat gives you 500% return. Worldwide infrastructure eeds

Ответить

It is the Dividend Growth Investor's dilemma: to sell or not to sell. I have mostly had regret when I sell a winner, so now my criteria for selling is a stock that cuts the dividend. Thanks for covering a topic that we all wrestle with. Wishing you all the best!

Ответить

I wouldn’t touch Pfizer.

Ответить

Also compare CAT to the return on simply investing in the S&P 500 index spider SPY. Since 2013 CAT total return was 263% vs. 226% for SPY (without reinvesting dividends on SPY).

Ответить

It's tough selling a winner, I'd say hold unless something comes up that you like a lot more or you think will out perform CAT over next couple years. Great stuff man!

Ответить

It's good to hear your investing thesis Ian. There are so many good buys right now to potentially deploy capital into for current yield, like MAA and O. Fire sales.

Ответить

When the price of a stock is extremely high and overvalued, the investor loses the margin of safety and takes on considerable risk. In this case, selling may be prudent. However, in your case, I don’t believe CAT is overvalued

Ответить

![Preview 2 RJ and Jimmy 2022 effects [Inspired by Preview 2 effects] Preview 2 RJ and Jimmy 2022 effects [Inspired by Preview 2 effects]](https://ruvideo.cc/img/upload/a3hzMFJFRnZqb1E.jpg)