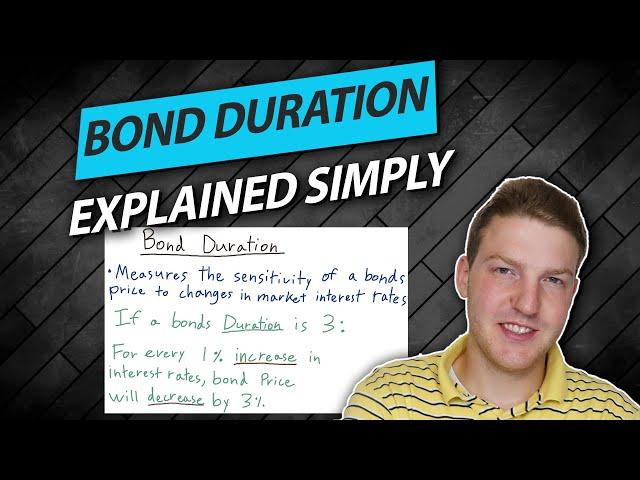

Bond Duration Explained Simply In 5 Minutes

Комментарии:

Thank you, this helped me for my capital market theory course.

Ответить

Thanks a lot for the amazing explaination.

Ответить

Thanks for the explanation. Really liked your approach in making it easy to understand.

Ответить

This is FUCKING AMAZING THANK YOU SO MUCH!

Ответить

Quick question, isn't modified duration what tells you how the price of a bond reacts to changes in interest rates while duration is the number of years for a bond to repay the investor?

Ответить

You are combining two measurements of duration.

Macauley is a measurement of time in which, for example, the appreciation gain of the bond due to a decrease in interest rates, is completely off set by the re-investment risk assumed by YTM. YTM assumes that the coupon payments can be re-invested at the YTM, when rates drop, the coupon payments must be reinvested at a lesser rate, this lowers overall YTM. At the same time, the bond appreciates due to the interest rate decrease - raising YTM. The point in time in which these two values are completely off-setting is Macauley Duration.

Modified duration is the sensitivity change to bond prices with a change in interest rates.

I have watched videos of 30- 60 Mins on Duration and none of those explained the meaning and calculation so easy to understand as yours. Thanks man.

Ответить

This is the only explanation that I ever understood! It’s bothered me decades that I never understood it. Thanks.

Ответить

adamsın

Ответить

Thank you soooo much, finally got that part! Wish you all the best!

Ответить

I love you, Ryan! Not in weird way, just a big fan of your teaching😊

Ответить

Finally someone explain it clearly

Ответить

Great video. Loved the explanation of the friend owing you money. Would you be able to explain intuitively why bonds with lower yields have higher durations?

Ответить

The best explanation ever! literally summarised 2 weeks of uni lecture into 5 mins. Brilliant work!

Ответить

Well explained.Thanks so much.

Personally I think they could have used a better word than "Bond duration" for this. it doesn't make much intuitive sense why the word duration will be used for such a sensitivity calculation.

Finally, I understand

Ответить

I LOVE YOU!! You explain amazingly. Thanks so much for this amazing content!

Ответить

Good explanation

Ответить

life saving love fromhong kong

Ответить

THANKS A LOT...... GOT CLARITY.. VERY USEFUL FOR MY PROFESSIONAL COURSE❤

Ответить

Thank you! This really helped me for my level 1 CFA study

Ответить

Very short and clear explanation

Ответить

The video won’t load

Ответить

Wouldn't the 2.75 that you calculate at the end be the modified duration, not the Macaulay duration as it is measuring the % change to a 1% change in interest rates and not measuring the time in years??

Ответить

So if the Macaualy Duration is 2.5Yr. That means it takes us 2.5 yr to recover our initial investment, and also means if rates go up 1% that our price changes by 2.5%? What confuses me is how the concept of years and % is interchangeable

Ответить

God bless you this is super helpful

Ответить

I really enjoyed a discussion of bonds that develops it beyond "if interest rates go up, the price of the bond will go down and vice versa". Thank you!

Ответить

Thank you 😭

Ответить

Thank you ☺️

Ответить

At last!!!someone who actually makes sense..thanks mate!!!

Ответить

I get how a bond duration tells you its price sensitivity in connection to a change in market interest rates. Doesn't Duration also tell you how long it takes for the investor to get their money back on their investment? If so, what would the 2.75 mean in terms of that?

Ответить

Thank you for the explanation, you just solved my problem.

Ответить

Easiest way to understand.....thnk a ton

Ответить

Great video and done so easy to comprehend. Thank you

Ответить

Finally I was able to understand how duration is calculated. Thanks for the clear and well-organized explanation.

Ответить

thank you for the explanation, very well explained

Ответить

爱你的教程,love from China

Ответить

Thank you!

Ответить

Just to be clear, this example would have the bond only paying 1 annual coupon payment right? In reality most bonds pay semi-annual right?

Ответить

I like how you breakdown everything, it's a lot easier to understand. ty :)

Ответить

You are the GOAT

Ответить

So, regard Macaulay duration (not ModMacDur) - can it be thought of as the amount of time to receive your initial purchase price back? Essentially the break even amount of time?

Ответить

Great Explanation !

Ответить

太感谢你了!

Ответить

How can IRS hedge portfolio duration?

Great video btw and you just earned yourself a new subscriber!