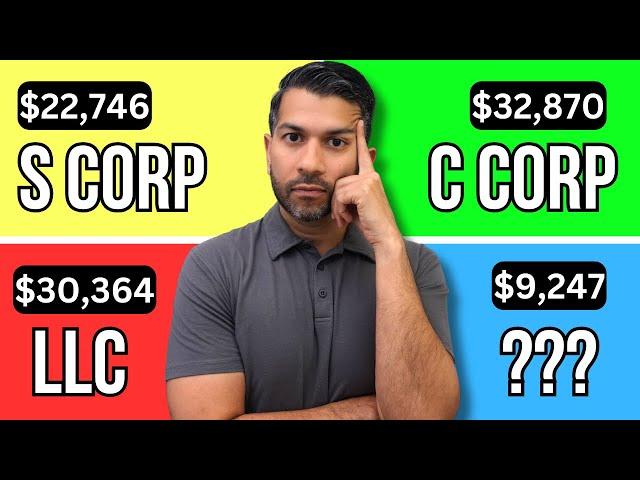

CPA EXPLAINS Tax Differences: LLC, S Corp, C Corp, Partnership, Sole Prop

Комментарии:

Great explaining these different business entities and how the tax implications can impact you. Best video I've seen so far. Definitely wanna check out your course.

Ответить

Great video!

Ответить

Tax laws can be so complex, and it’s super helpful to break them down like this. Understanding how different policies can impact our finances is crucial for making informed decisions.

Ответить

Thank you for this explanation! 🌺

Ответить

No one should worry about s corps or llc until your buisness turns profit or you need a legal entity for payment processor it's just a way of lowering personal liability and you can file the paperwork at through your state and state website save money.

Ответить

Great video! Currently have a S Corp will convert to a C Corp soon. Then open another C Corp for another industry. I was told that its less hassle to get a loan with a C Corp vs S Corp if need be.

Ответить

Great video! Currently have a S Corp will convert to a C Corp soon. Then open another C Corp for another industry. I was told that its less hassle to get a loan with a C Corp vs S Corp if need be.

Ответить

Fantastic presentation!!

Ответить

How do business write offs come into play? Is that part of the 25K expenses?

Ответить

Outstanding video. Thank you. FYI: NH also has no state income tax.

Ответить

Best one to save on Alimony and chlid support?

Ответить

Can a partnership be created between an individual and an llc?

Ответить

do you also provide income tax service for someone who want and are on LLC?

Ответить

Thank you so much for this video! so helpful!

Ответить

Can you revisit the benefits of having a C-Corp owned by your self-directed ROTH IRA or Solo 401K Single member LLC?

C-Corp pays tax on EBIT and you can elect to have all of the after tax profit paid to your SD IRA’s (or Solo 401K) LLC. Qualified DIVIDENDS are passive income and therefore not taxable inside you Roth IRA

Navi in order to be set up as a S Corp do you have to revenue a certain amount?

Ответить

Great explanation

Thank you, really enjoyed

The financial system has been artificially pumped for over a decade to ensure big pockets were lined; and now those same hands will make a fortune in the largest transfer of wealth in human history by shorting it on the way down. Inflation does have a roll, but that's to keep everyone panicked, and focused on their bills and expenses, rather than focus on the capital crimes of politicians and corporations,I'm still at a crossroads deciding if to liquidate my $338k stock portfolio, what’s the best way to take advantage of this bear market??

Ответить

Loved this!! Thank you🙏🏾

Ответить

Any way we could get our hands on that excel file? :D

Ответить

Really appreciate your insights

Ответить

Thank you this was really helpful

Ответить

If the LLC elects to be taxed as an S corp, do those S corp numbers apply to each member of the LLC?

Ответить

Please explain the FIT tax for S corps.

Ответить

Won't the S Corp eventually have to pay tax on the 60,000?

Ответить

Amazing explanation!! Thank you!

Ответить

as someone with ZERO tax knowledge even back when i was under W2's this is explained so well, i understood everything! thank you so muchhhhh

Ответить

Many thanks

Ответить

my man. so helpful.

Ответить

I think the numbers would be different with c vs s corp when revenue is like a million or above, In such cases I guess one can benefit from C corp by reinvesting the money in another business or something

Ответить

Where was just the LLC?

Ответить

The S-Corp 60-40 split was not explained for the 60 side.

Ответить

Simple overview, but missing a lot of important content to compare an s-corp vs Inc. need to consider expenses, solo 401k contributions, and many other ways to shelter income in a separate legal entity

Ответить

Since sole corporation is a flow-through entity, do owners pay income taxes on distributions in addition to the federal income tax and how does it reflect on the balance sheet in the equity section?

Ответить

I saw your other video that shows s-corp can be charged capital gains tax, how come you excluded it here? Or, did the rules change?

Ответить

Curious about the ??? and $9247 ?! is that another entity or just a thumbnail? Thank you. It is a great video.

Ответить

The best explanation yet!

The only thing I didn’t see you explain was retained earnings and how they are taxed differently and how a different structure(c corp) can reduce tax on retained earnings.

Taxes are voluntary in this country. You pay taxes out of fear and ignorance

Ответить

Why for the partnership you doubled the amount ? Instead of breaking down the numbers based off the same 125k in the rest and does this mean I can just divide all the numbers in half and use those numbers as a reference

Ответить

I liked the way you explained. Thank you so much!

Ответить

great explanation, I have a question, I am Canadian and I own a C-corp as I have a business in the USA, what happens to social security and Medicaid as I don't have status in the US

Ответить

Why would a single owner opt for an LLC over S Corp if the tax savings are so significant with the S Corp?

Ответить

This video is well done and easy to follow. Is there a way that I can get a copy of the spreadsheet?

Ответить

Can also add Trust into this equation . For property management business

Ответить

I'm curious about your s-corp numbers, specifically, the numbers related to the $60,000. I can't figure out how $60,000 results in the same numbers as the $40,000 in the s-corp column. I'm getting $3,720 for Social Security and $870 for medicare. Does the s-corp ONLY pay the same amount as what the employee has to pay without regard to the fact that it's $20,000 higher? In other words, does the s-corp only have to match the employee's social security and medicare contributions instead of paying the same percentages as the employee?

Ответить

Very helpful thanks

Ответить

great video.. easy to understand..

Ответить

The big problem with the Corp S is that on a personal level it affects you a lot, since it distributes dividends or not, you must pay for them in your personal taxes and your health insurance skyrockets among other things

Ответить

I have a question. Considering personal cash flow the sole prop and general part, the individual gets taxed at a personal level and they get those funds. And a C-corp the owner takes a salary and the C-corp gets taxed on the $60m and if the owner wants those funds the need to take a distribution, they can't just pulled money from the register like a sole prop and gen part can do. But what you don't show is, how does the S-corp treat the $60m that was taxed on the corp level? Don't they have to take a distribution also? And they don't get taxed then, correct? And if so, can't they skip the salary and take a distribution instead? I work at a bank and I see a lot of S-corps and this seems to be the norm.

Ответить

I have uploaded the free “help” and it doesn’t respond to any entry. What do I do wrong.

Ответить