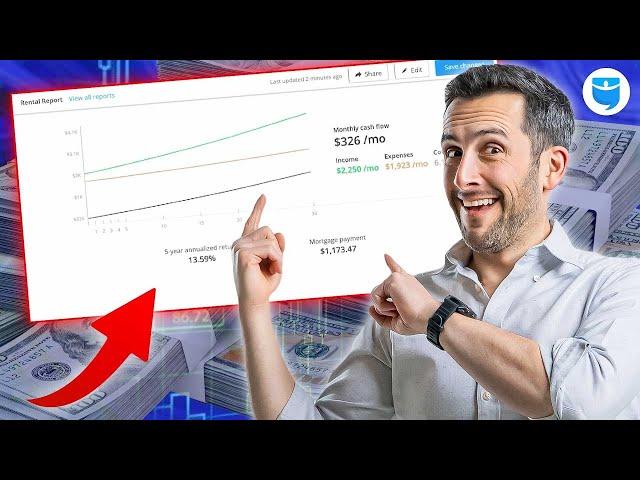

Calculating Numbers on a Rental Property (In 20 Mins or Less!)

In this video, you’ll learn how to analyze a rental property in MINUTES. Even if you have ZERO experience in real estate investing, you can calculate cash flow, estimate rent, and easily see whether or not a property is worth purchasing. Dave Meyer, VP of Data and Analytics at BiggerPockets, will walk step-by-step through running real estate numbers so you can confidently invest in 2023.

NO spreadsheets, NO intense calculations. You can run these numbers in just a few minutes with the BiggerPockets rental property calculators. Instantly find how much your property could rent for, put in some basic rental assumptions, and you’ll be given everything you need to get funding AND feel ready to start your real estate investing journey.

Want to invest like the pros? Sign up for BiggerPockets Pro with code “REVIEW20” and get 20% off PLUS a copy of Dave’s new book, “Real Estate by the Numbers”: https://www.biggerpockets.com/membership-types?utm_source=owned_media

~~~~

Join BiggerPockets for FREE 👇

https://www.biggerpockets.com/signup?utm_source=owned_media

~~~~

Find an Investor-Friendly Agent in Your Area:

http://biggerpockets.com/agentmatch

~~~~

Find Investor-Friendly Lenders:

http://biggerpockets.com/lendermatch

~~~~

BiggerPockets Calculators Used in This Video:

Rental Property: https://www.biggerpockets.com/rental-property-calculator?utm_source=owned_media

Rent Estimator: https://www.biggerpockets.com/insights/property-searches/new?utm_source=owned_media

~~~~

Get State-Specific Leases for Your Next Rental:

https://get.biggerpockets.com/forms/index/?utm_source=youtube&utm_medium=description&utm_campaign=none

~~~~

Housing Market Data Sources:

FRED: https://fred.stlouisfed.org/

Redfin: https://www.redfin.com/news/data-center/

Realtor: https://www.realtor.com/research/data/

Zillow: https://www.zillow.com/research/data/

~~~~

Connect with Dave on BiggerPockets:

https://www.biggerpockets.com/users/davem27?utm_source=youtube&utm_medium=description&utm_campaign=none

~~~~

Follow Dave on Instagram:

@thedatadeli or https://www.instagram.com/thedatadeli/

FRED® Graphs Federal Reserve Bank of St. Louis. 2022. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. https://fred.stlouisfed.org/

Тэги:

#rental_property #calculating_numbers_on_a_rental_property #how_to_analyze_a_rental_property #how_to_analyze_rental_property_investment #income_property #investment_property #how_to_invest_in_real_estate #analyzing_real_estate_investments #rental_properties #passive_income #cash_flow #how_to_calculate_cash_flow #calculate_cash_flow #cash_flow_real_estate #housing_market #rental_property_calculator #rental_calculator #biggerpockets #dave_meyer #datadeliКомментарии:

When house sale prices skyrocketed, landlords jacked up the rent prices. When sale prices go down, will landlords lower rent?

Ответить

Great breakdown here. I invest specifically in multifamily and first do quick “back of the napkin” underwriting to see if the deal is worth diving deeper into. I’ll take gross income, multiply by 45% (conservative expense ratio) then divide that by my market cap rate to get a purchase price. If the seller’s asking price is in the same ball park, that tells me based on the numbers that the seller is not being unrealistic.

Ответить

Wonderful explanation

Ответить

What great timing. I was just watch an older video on this same content. I’m glad it’s now updated info! Thanks for reading my mind. 😉

Ответить

Very helpful awsome. More content like this

Ответить

Your property taxes were input as $156 annually. Was this suppose to be monthly? Because on the surface a deal with rent less than 1% of purchase price with interest rates today should be near 0 or even negative cash flow.

Ответить

I was just quoted a 30 year rate of 7.625! 810 credit score with income above 150k and no debt other than house and a heloc. Hard to find cash flow with that rate

Ответить

Having a strong investment narrative alongside some robust numbers - you’re gonna have a good time

Ответить

The most popular video on the channel is "Calculating numbers for rental property." I understand the objective is show people how easy it is but you don't need to rush through the process and feel like it has to be condensed to 20 minutes. Viewers such as myself are new and would like to understand all of the details. With that said, thank you for the video!

Ответить

Does biggerpockets do their own backround analysis on the property you enter and move in for the kill? Lol

Ответить

Bigger pockets is one hell of a community 💪🏾Brandon Turner is honestly a Real Estate legend

Ответить

How much does it cost per month to get access to these Bigger pocket tools

Ответить

What do you mean by the seller may “buy down your rate”? Please elaborate on those real estate terms you use

Ответить

Now where are you getting the cash to buy these properties, sounds good but reality is not that many people have cash AND can get a loan, Maybe one loan but several oans its going to be stretch. Please elaborate on where the cash comes from...20-25% on each deal....????

Ответить

Investment rates are definitely not at 6.8% .

More at 8% with 2 points

Thank you for the breakdown of this essential information.

Ответить

Something older investors need to take into consideration (and really anyone for that matter) Is what are the current terms of the lease and any immediate reno needs. Example: There was a duplex next to a duplex we own that was impeccably maintained, both kitchens recently redone, new roof 8yrs ago, excellent long term renters. Wife and I always said we would tender an offer if it ever came up for sale. When that happened in the summer of 2022 interest rates jumped from 4% in the spring to 6+% (round numbers). We knew what markets rents would bring for this unit. The listing said both leases were up at 3 mo and 4mo away. We were excited and about to put in an offer when we found out 2 important pieces of info. First, leases weren't actually up for 15mo and 16mo (I believe listing agent fudged that info) and the current landlord never raised rents for 17yrs on either unit! Yes, that's correct, putting the total rents close to $2k behind market and creating a serious negative cash flow. We are retired but always looking to expand our holdings with the right opportunity but taking a huge financial hit for that long didn't make sense for us. Ultimately it sold with a younger owner occupied couple. Moral of the story... double check the accuracy of those claimed numbers!

Ответить

Great book, great structure and level of details, answered for me a ton of questions on what, when, how much and should I... totally recommended, especially for free!

Ответить

Excellent breakdown. I definitely will be bookmarking this video.

Ответить

Has anyone found a site to get quick home insurance quotes? I know the quick quotes are not 100% perfect, but I'm looking a quicker way instead of having to call an insurance agency everytime. Tried the Hippo site, a waste of 10 mins lol

Ответить

Really appreciate just seeing what tools are used for this. Thanks!

Ответить

Where did you get the red lines for the charts in the beginning?

Ответить

I’d would’ve liked to see a more in depth method for checking rents other than the BP rent estimator. Every time I use it it’s not even close to accurate. But really great video regardless.

Ответить