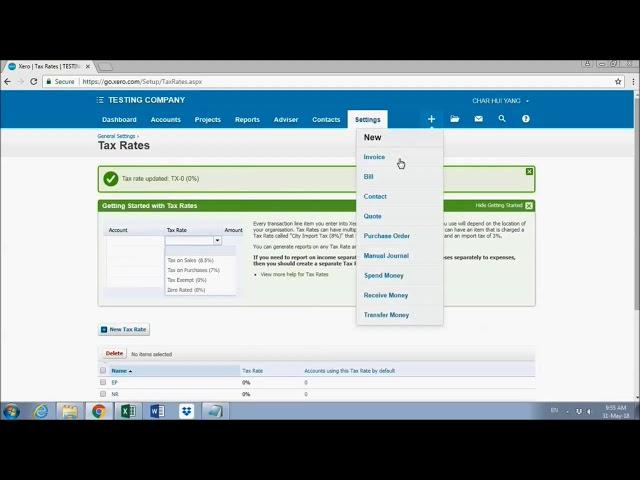

GST Tax Code Update (Xero Malaysia)

Malaysia GST will change from 6% to 0% since 1 June 2018, do you know how you change it in Xero Accounting software?

GST Software upgrade FAQs:

1) Must I update my accounting software?

Some of the accounting software (e.g. Autocount, SQL, etc) will link the amended Tax code (SR-0) to form GST-03 directly. There is a risk that the software will malfunction if it was not updated.

Some of the accounting software (e.g. Xero, quickbook, etc) are cloud accounting software, they will automatically update to newest version. Therefore, you don’t need to update it yourself.

2) Where I shall go to download updated software?

We advise you to consult with your software vendor. You may refer to the software vendor contact below if you don’t have a trusted software vendor.

3) Will there any additional charges for software update?

Yes, most of the software vendor will charges for the update. However, the update will be free if you has signed maintenance contract with those software vendor. We suggest you to sign one year maintenance contract with those software vendor as our government estimated to implement SST on September 2018, so you don’t need to pay again during that time.

4) Can I choose not to update the software, and add in the new Tax code (SR-0) into the system myself?

It’s depend on what software you are using now, some of the software (e.g. Xero can add in new Tax code directly), but some of the software (e.g. Autocount or SQL) request you to update the software to avoid software malfunction.

5) Shall I follow tax invoice format to issue tax invoice after 1 June 2018?

Yes, existing GST Act is still enforcing, you shall continue follow all related rules and regulations.

6) What is the new Tax code to be used for supply of goods/services?

SR-0 or any code that the company uses for standard rated local supplies at 0%.

7) What is the new Tax code to be used for acquisition of goods / services?

TX-0 or any code that the company uses for standard rated local purchase at 0%.

8) Shall the tax invoice issue after 1 June 2018 stated 0% GST?

Yes, you are required the goods or services are charged at 0% GST.

9) What I shall do if my products or services supplied before 1 June 2018, but the tax invoice issued after 1 June 2018, system will automatic change to 0% GST?

We suggest you issue the invoice date before 1 June 2018 to avoid confusion. RMCD has the right to collect 6% GST from this invoice (And you are hard to collect back from client).

10) What I shall do if my products or services supplied after 1 June 2018, but the tax invoice issued before 1 June 201, system will automatic change the tax rate to 6%?

We suggest you change the invoice date on or after 1 June 2018 to avoid confusion.

11) Can I still claim the input tax (on the invoices issued before 1 June 2018) if I received the suppliers invoices after 1 June 2018?

Yes, you can claim it.

12) Shall I continue submit form GST-03?

Yes, you shall continue submit form GST-03 until further notice from RMCD.

13) I am not GST registered person, can I claim the input tax of 31 May 2018 closing stock from RMCD?

No, you cannot claim it from RMCD.

14) I am zero rated GST registered person, which tax code I shall use on and after 1 June 2018? SR-0

15) Shall I charge 0% or 6% GST on the payment (deposit or full sum) before 1 June 2018, which products or services supplied after 1 June 2018?

Based on the FAQ issued by RMCD on 30 May 2018, you shall charge 6% GST.

_________________________________________________________________

Accounting Software Vendor:

Autocount Accounting Software

Ms Lee (+6018-7718402)

Tel: +607-8626608

Email: [email protected]

SQL Accounting Software

Winnie (+6019-7330035)

Tel: +607-2132219

Email: [email protected]

Cloud Accounting Software (Xero or Quickbooks)

Ms Yang (+6018-8708900)

Tel: +607-8590410 Ext 814

Email: [email protected]

Million Accounting Software

Rockbell Software Sdn Bhd

Tel: +607-3340707

Email: [email protected]

_________________________________________________________________

Thanks for your watching!

Please like and share if you like our video!

We specialize in handling Malaysia Income tax, accounting and Auditing.

Official Website: www.liew.my

Facebook page: www.facebook.com/landco.malaysia

GST Software upgrade FAQs:

1) Must I update my accounting software?

Some of the accounting software (e.g. Autocount, SQL, etc) will link the amended Tax code (SR-0) to form GST-03 directly. There is a risk that the software will malfunction if it was not updated.

Some of the accounting software (e.g. Xero, quickbook, etc) are cloud accounting software, they will automatically update to newest version. Therefore, you don’t need to update it yourself.

2) Where I shall go to download updated software?

We advise you to consult with your software vendor. You may refer to the software vendor contact below if you don’t have a trusted software vendor.

3) Will there any additional charges for software update?

Yes, most of the software vendor will charges for the update. However, the update will be free if you has signed maintenance contract with those software vendor. We suggest you to sign one year maintenance contract with those software vendor as our government estimated to implement SST on September 2018, so you don’t need to pay again during that time.

4) Can I choose not to update the software, and add in the new Tax code (SR-0) into the system myself?

It’s depend on what software you are using now, some of the software (e.g. Xero can add in new Tax code directly), but some of the software (e.g. Autocount or SQL) request you to update the software to avoid software malfunction.

5) Shall I follow tax invoice format to issue tax invoice after 1 June 2018?

Yes, existing GST Act is still enforcing, you shall continue follow all related rules and regulations.

6) What is the new Tax code to be used for supply of goods/services?

SR-0 or any code that the company uses for standard rated local supplies at 0%.

7) What is the new Tax code to be used for acquisition of goods / services?

TX-0 or any code that the company uses for standard rated local purchase at 0%.

8) Shall the tax invoice issue after 1 June 2018 stated 0% GST?

Yes, you are required the goods or services are charged at 0% GST.

9) What I shall do if my products or services supplied before 1 June 2018, but the tax invoice issued after 1 June 2018, system will automatic change to 0% GST?

We suggest you issue the invoice date before 1 June 2018 to avoid confusion. RMCD has the right to collect 6% GST from this invoice (And you are hard to collect back from client).

10) What I shall do if my products or services supplied after 1 June 2018, but the tax invoice issued before 1 June 201, system will automatic change the tax rate to 6%?

We suggest you change the invoice date on or after 1 June 2018 to avoid confusion.

11) Can I still claim the input tax (on the invoices issued before 1 June 2018) if I received the suppliers invoices after 1 June 2018?

Yes, you can claim it.

12) Shall I continue submit form GST-03?

Yes, you shall continue submit form GST-03 until further notice from RMCD.

13) I am not GST registered person, can I claim the input tax of 31 May 2018 closing stock from RMCD?

No, you cannot claim it from RMCD.

14) I am zero rated GST registered person, which tax code I shall use on and after 1 June 2018? SR-0

15) Shall I charge 0% or 6% GST on the payment (deposit or full sum) before 1 June 2018, which products or services supplied after 1 June 2018?

Based on the FAQ issued by RMCD on 30 May 2018, you shall charge 6% GST.

_________________________________________________________________

Accounting Software Vendor:

Autocount Accounting Software

Ms Lee (+6018-7718402)

Tel: +607-8626608

Email: [email protected]

SQL Accounting Software

Winnie (+6019-7330035)

Tel: +607-2132219

Email: [email protected]

Cloud Accounting Software (Xero or Quickbooks)

Ms Yang (+6018-8708900)

Tel: +607-8590410 Ext 814

Email: [email protected]

Million Accounting Software

Rockbell Software Sdn Bhd

Tel: +607-3340707

Email: [email protected]

_________________________________________________________________

Thanks for your watching!

Please like and share if you like our video!

We specialize in handling Malaysia Income tax, accounting and Auditing.

Official Website: www.liew.my

Facebook page: www.facebook.com/landco.malaysia

Тэги:

##GST ##Malaysia_GSTКомментарии:

GST Tax Code Update (Xero Malaysia)

Accountant & Auditor Malaysia - L&Co Plt

Video Mercenary 8 #shorts

Easy Dreams Cult

Omsi 2 ЛАЗ-699 /LAZ-699

Pickloop

Edo i Sateliti Drine - Zeno moja, ljepotice - NOVO - (Official video 2015)

Izvorna Muzika Extra Music Official

DUNIA TERBALIK - Ceu Yoyoh Ingin Tanyakan Ini Pada Esih [26 Juli 2019]

RCTI - LAYAR DRAMA INDONESIA

AutoRanc-Car Presentation - Mercedes Benz C 220CDI Coupé 105kW/143PS, www.autoranc.sk

Car Video Presentation - AutoRanc

goroutines: Qué, Cómo y Por qué?

Go Simplified

Il tuo appartamento CHIAVI IN MANO

Federico Auteri

Terrible Addiction Recovery Advice That Everyone Believes (but shouldn't)!

Put The Shovel Down

![DUNIA TERBALIK - Ceu Yoyoh Ingin Tanyakan Ini Pada Esih [26 Juli 2019] DUNIA TERBALIK - Ceu Yoyoh Ingin Tanyakan Ini Pada Esih [26 Juli 2019]](https://ruvideo.cc/img/upload/RUpYcFFHbEhZYnQ.jpg)